When Anglo American and Teck Resources announced a proposed merger to form a $53 billion “Anglo Teck” copper giant, I had to re-read the headlines. Has the mining world finally found its nerves? Not since Glencore’s Xstrata deal in 2013 has such a scale of consolidation been attempted. In fact, Reuters immediately labeled it “the sector’s second-biggest M&A deal ever”. In our risk-averse era of quarterly earnings pressure, two major miners are making a surprisingly audacious move. They are effectively asking: Is copper now so critical that it justifies a dramatic strategy, rather than incremental acquisitions?

I must confess, as an investor steeped in commodity cycles, this deal felt oddly exhilarating. Just months ago Anglo had declined BHP’s massive bid, and Teck had rebuffed Glencore’s attempt. Now, they’re combining forces. It’s quite a strange, even daring move and while the crowd is still timid, Anglo and Teck are charging into the fray.

For me, the catalyst came quietly one evening. I was scanning Bloomberg news on China’s battery wars and Nickel Creek’s troubles when the Anglo-Teck news flashed on my screen. Suddenly, it was as if the entire narrative shifted: a $53 billion all-share merger of equals (or nearly equals) creating a copper-focused powerhouse. And not a moment too late.

“The impediment to action advances action. What stands in the way becomes the way.”

-Marcus Auerlius

The sheer boldness of this deal is forcing us to reassess our contrarian theses. Lets look at some of the hidden forces, underpinning this transaction.

Why Copper Matters More Than Ever

Copper is not just another commodity. It is the lifeblood of the 21st-century infrastructure – the wiring and veins of a green, digitized world. Billions are being funneled into modernizing power grids, expanding 5G networks, and building data centers for AI. All of it requires copper. The International Energy Agency projects that by 2040, over 40% of total demand for copper (and rare earths) will come from clean energy technologies like EVs, solar farms, wind turbines and grid upgrades. And guess what? Supply is already lagging. World copper inventories are at multi-decade lows, prices are surging toward record highs, and new mine lead times now exceed 14 years. See our previous post on copper:

The Largest Copper Project In Africa Is Being Built - Koryx Copper (CVE:KRY)

The most critical assets are often the most overlooked. While global headlines chase the high-flying valuations of lithium and rare earths, the true engine of the global economy is copper.

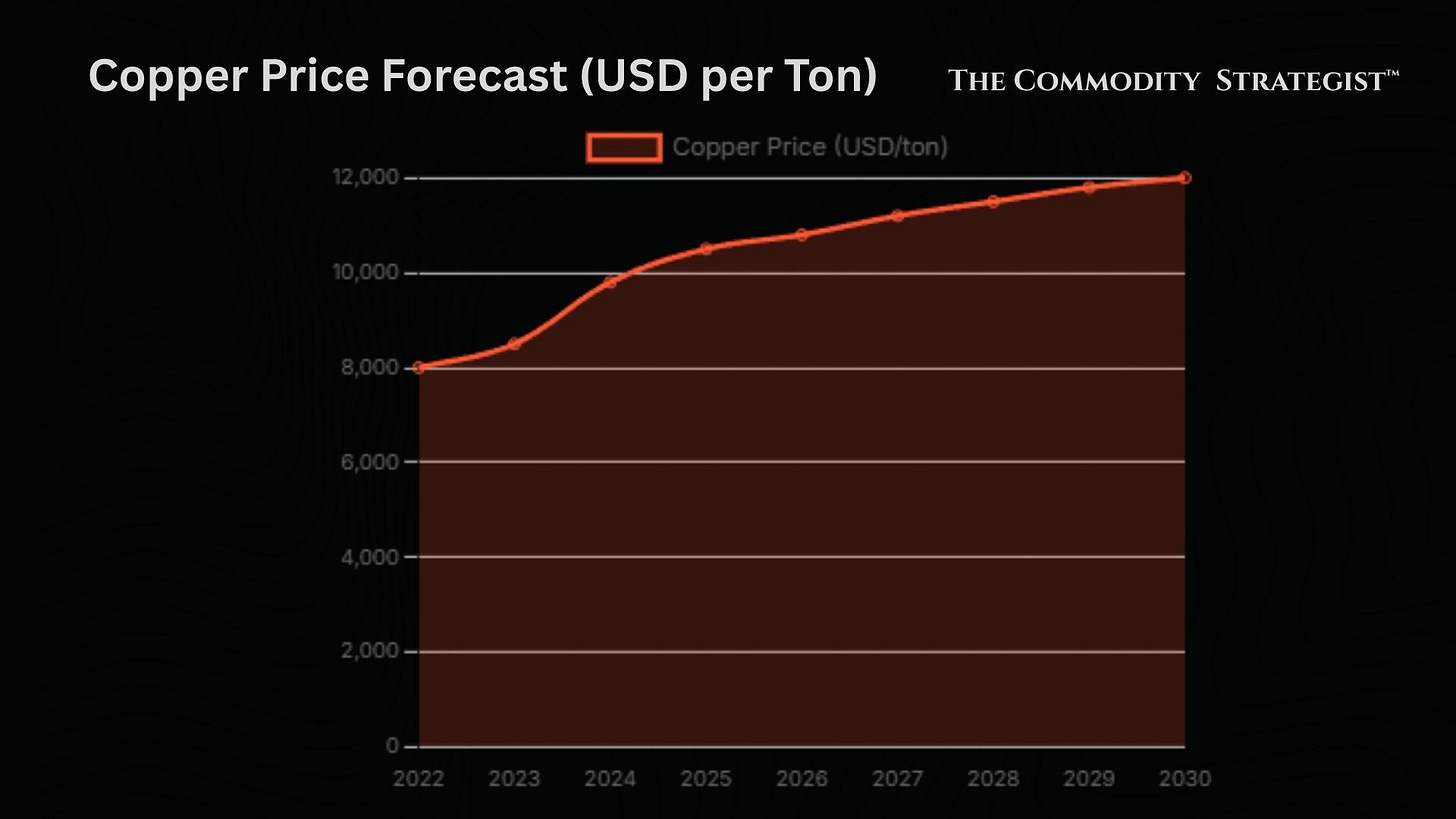

Just last month, Reuters reported that copper demand is “rising faster than the industry anticipated”, driven by a record $400+ billion global grid investment and an explosion in data center power needs. Analysts see the copper market tightening alarmingly: predictions of $12,000+ per ton by the end of the decade are being thrown around. Electric vehicles, in particular, are using copper at an unprecedented rate – demand from EVs alone is forecast to grow from ~1.2 million tonnes in 2025 to ~2.2 million tonnes by 2030. In plain terms: copper is moving from a cyclical industrial metal to a structural bottleneck of the energy transition.

As investors we knew this story was brewing. What Anglo and Teck are saying, in effect, is that: they are not waiting around. They want to capture that demand upswing with scale and integrated operations. They are betting on the clean energy transition making copper the most strategic metal of the decade.

Look at it this way: every wind farm needs kilometers of copper wire; every EV needs kilos of copper in its electric motor and wiring. Governments are pledging infrastructure spending; corporations are ordering batteries and servers; data centers are building at frantic pace. We’ve heard glib phrases about “peak oil” and “the next oil”, but here’s a more accurate one: we have a copper crunch, not an oil glut. Even savvy cable makers say people often misjudge just how much copper this will require.

“Luck is what happens when preparation meets opportunity.” - Seneca

In this case, the opportunity is certainly at hand – governments and tech companies have planned it out; the preparation is in owning the mines.

Six World-Class Copper Mines, One Company

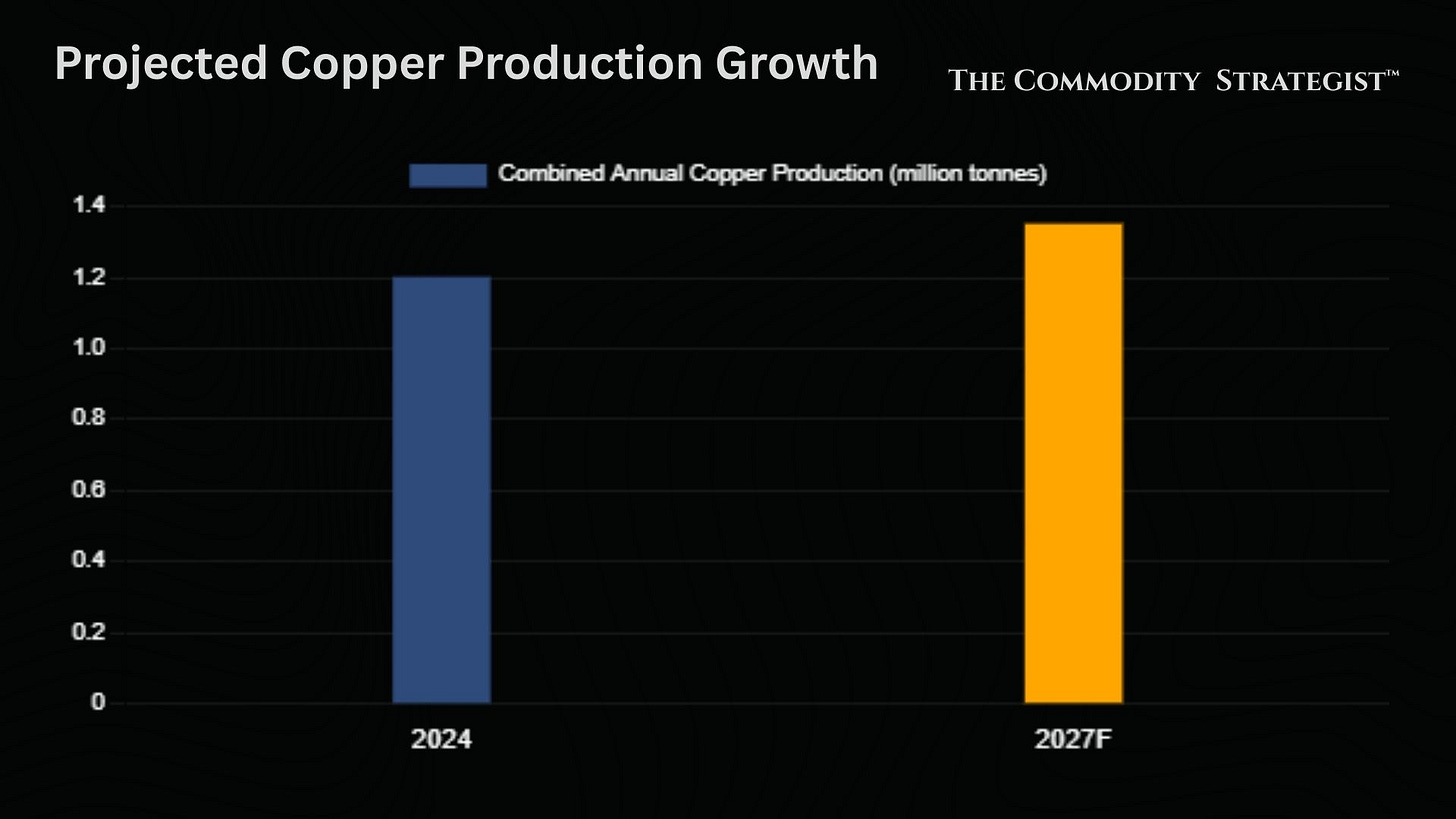

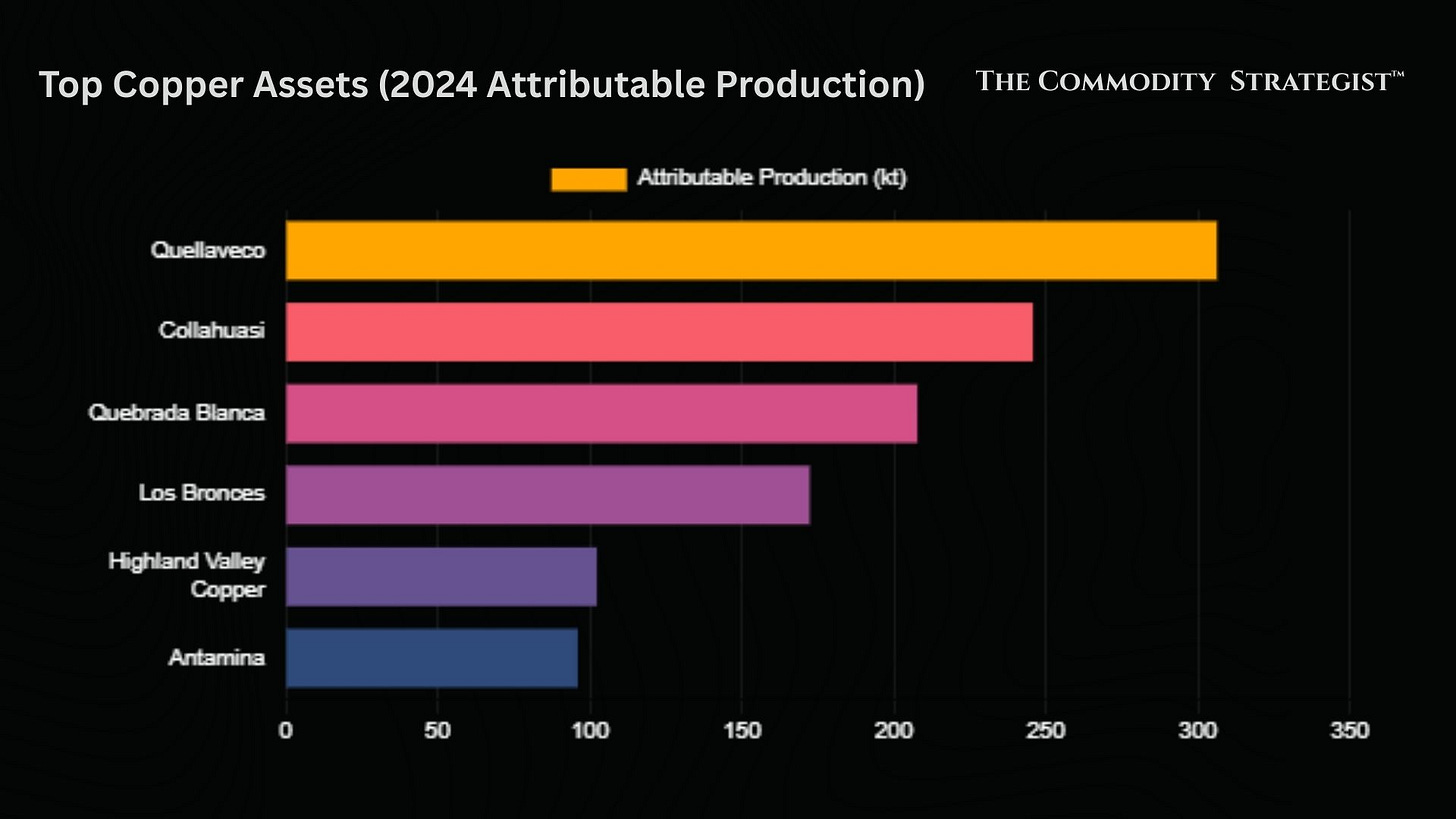

Let’s look into what Anglo Teck will actually be. The combined portfolio is nothing short of a copper constellation. According to the companies’ own disclosures, Anglo Teck will “hold an industry-leading portfolio of producing operations, including six world-class copper assets”. Those assets span two continents: Collahuasi (Chile), Quebrada Blanca (QB2, Chile), Quellaveco (Peru), Los Bronces (Chile), Highland Valley Copper (Canada), and Antamina (Peru). Together, these mines could produce roughly 1.2 million tonnes of copper a year today – more than anyone but Codelco or Freeport-McMoRan – with plans to lift output to about 1.35 Mt by 2027

.

Think about the quality: Collahuasi is one of the world’s richest copper deposits, and Los Bronces is a massive Chilean complex nearing full-scale production. Teck’s QB2 is a high-grade, deep-mineral deposit (with a quirky tailings issue, as we’ll come to) and Highland Valley is a mature, low-cost North American mine with room to grow. Quellaveco just started producing and promises clean, high-grade copper. Antamina, though a smaller stake, adds further Peruvian volume. This mix provides geographic balance (Chile + Peru + Canada) and offsets.

The companies are selling it as “not just scale, but high quality.” In fact, Panorama Minero sums it up: “Key assets include Collahuasi, Quebrada Blanca, Quellaveco, Los Bronces, Highland Valley Copper, and Antamina”. They’re right. For copper bulls, this is a dream lineup.

More than just hoisting numbers, the beauty of this portfolio is how complementary the pieces are. Anglo’s recent strategy was to pare down, focusing on core mines. Teck had just shorn off its coal business and was effectively a copper/zinc pure-play. Join them, and you get one carbon-reduced, diversified enterprise. There’s also premium iron ore and zinc from Anglo’s assets (e.g. Minas-Rio, Port Pirie zinc, Teck’s Red Dog) to lend ballast. But copper drives the narrative – indeed, Anglo Teck will be “more than 70% copper exposure” by earnings, with iron ore, zinc and even some crop nutrients (think potash from Teck’s interest) as nice-to-haves.

Crucially, this merger isn’t just about owning more land. It’s about operational synergy. The front-row example is Chile: Quebrada Blanca and Collahuasi are literally next door (both in Northern Chile’s Atacama region). By integrating those operations, the companies expect to unlock enormous value. Teck’s release highlights $1.4 billion in “underlying EBITDA uplift” from coordinating Collahuasi and QB2 between 2030–2049 – equivalent to roughly 175,000 extra tonnes of copper annually once fully realized. In practice, that could mean optimizing processing, sharing infrastructure (roads, power, personnel), and squeezing out cost redundancies.

Beyond that, the companies cite roughly $800 million per year in recurring pre-tax synergies (by year four post-close) from consolidation. Think about it: that’s nearly $1 billion of cost cuts and efficiency gains annually just from scale, overlapping functions and buying power. Combined with $1.4 billion from the Chilean adjacencies, this merger isn’t just adding; it’s multiplying the output for investors.

Even on capital, they’ll be stronger. Both Anglo and Teck enter with rock-solid balance sheets and cash reserves (Anglo still carries large iron ore receipts, and Teck just sold its coal arm for nearly $7 billion). Anglo is sweetening the deal by issuing a $4.5 billion special dividend to its shareholders beforehand, so investors get immediate cash as compensation. Post-close, shareholders will own roughly 62.4% (Anglo side) and 37.6% (Teck side) of Anglo Teck. Importantly, the new company will be more liquid and debt-light, with listings across London, Toronto, New York and Johannesburg – enhancing global capital flexibility. As Anglo’s CEO Duncan Wanblad puts it, the combined firm will have “greater flexibility to reallocate capital dynamically to the highest returning opportunities”. In plainer terms: they can pick and choose where to put growth dollars as markets evolve.

The story behind-the-scenes also shows conviction. Both companies turned down larger takeover bids; this union is their choice of partner. It’s a bit like two chess grandmasters agreeing to a new team game instead of fighting it out. They’re teaming up to play a deeper game.

Consolidation and Courage in Mining

Anglo Teck is not an isolated incident but a sign of the times. The mining sector has entered a flurry of M&A activity unseen since the post-supercycle boom. There have been 18 deals above C$1 billion totaling ~C$47 billion between Jan 2024 and mid-2025. That already eclipses the peak of 2011–2012. Importantly, this wave is driven not by cheap cyclical plays, but by strategic imperatives such as geopolitical uncertainty, trade disputes, rising costs, supply gaps, and the accelerating shift toward clean energy. In this context, mining companies aren’t speculating – they’re securing their futures.

Copper is at the center of that rush. Rather than betting on long, costly brownfield growth projects (many of which face 14+ year approvals), firms are opting to buy mines. Recall that since 2021, global copper inventories plunged to multi-decade lows, and the average time to bring a new mine online exceeds 14 years. Who has 14 years to spare in an energy-transition race? The rational answer has become to snap up producing assets or near-producing projects.

We’ve seen so many test cases: BHP’s aborted bid for Anglo (and its simultaneous JV with Lundin on Filo del Sol); Glencore’s aborted merger with Teck’s coal unit in favor of this deal; other mid-tier firms scooping up mines. Gold hasn’t been left out (Newmont/Orla, Gold Fields/Gold Road), but the critical-minerals angle is very clear. Every renewable, EV and grid venture needs copper, nickel, lithium, cobalt, rare earths, etc. This Anglo–Teck move is the linchpin symbol: massive copper consolidation to ensure supply of a critical mineral, even as many of the industry’s titans were building moats around their assets.

Frankly, bold M&A transactions like this are rare. Mining is traditionally conservative: massive capital expenditure, long gestation projects, opaque commodity cycles. Companies usually savor stable cash flows rather than shaking up balance sheets. We saw companies spin off or refocus (Anglo spun platinum, for example), but doing an equal merger to double-down on one metal, in plain sight of regulators? That’s a wager you wouldn’t have overheard at many boardrooms a decade ago.

Navigating the Hurdles

Of course, none of this is guaranteed smooth sailing. Any merger of this size carries red flags. Let’s not gloss over the risks – but let’s also reframe them as part of the long-cycle vision this merger embodies.

First, regulatory approval looms large. Anglo Teck will be dual-stock-listed and “horizontal” in copper, so antitrust bodies in multiple jurisdictions will scrutinize it. The deal announcement itself acknowledges it’s subject to “customary closing and regulatory conditions”. Teck’s CEO cautioned it could take “12 to 18 months” just to clear the approvals gauntlet. Authorities in Canada (notoriously protective after Glencore’s bid), the EU, the US, and even Chile will have their say. Yes, Anglo agreed to site the HQ in Canada (and swing a big dividend to Canadian shareholders) partly to appease Ottawa. A source told Reuters that moving the HQ and giving Teck’s founder family a big vote “would likely help ease the way for regulatory approval”. But even so, nothing is certain. Antitrust could demand divestitures or impose conditions. And in a split-metal deal, national governments worry about securing “critical minerals” domestically.

Second, integration complexity cannot be understated. We’re talking about melding two corporate cultures (an old-school British/South African miner and a Canadian miner known for its engineering), systems, supply chains and labour forces. Mining projects have notoriously detailed technical and environmental needs. For example, Teck’s QB2 mine has encountered a tailings disposal issue that has already set back production and depressed Teck’s stock. Will Anglo Teck fix that quickly, or does it become a headache of its own? There’s the practical risk that projected synergies fall short. After all, how many big combinations in any industry fully meet cost-savings targets?

Third, geopolitical and market risks loom. Copper isn’t immune to politics: the US imposed a 50% tariff on some Chinese copper imports in August 2025, sending jitters through the market. If trade wars escalate or key markets slow, copper prices could tumble. Meanwhile, resource nationalism, environmental protests, or even local politics (remember the Chilean elections, or Peru’s sometimes turbulent mining policy?) could bite into profits. Currency swings and changing interest rates also affect project economics. All these factors are outside the CEO’s control, yet will impact Anglo Teck’s bottom line.

None of these should be ignored. But as long-term investors, perhaps we see them differently. Each risk is also why the potential prize is so great.

“He who has a why can bear almost any how.” - Nietzsche

The why here – supplying the world’s copper for decades – is so clear and so vital that the parties clearly believe it justifies the journey through these hows.

“every obstacle (regulatory delay, cultural clash, commodity downturn) is the raw material to become stronger.” - Marcus Aurelius

In the context of long cycles, the toughest issues become the price of doing bold business. Miners know cyclical issues (labour strikes, capital cost inflation, resource depletion) are par for the course. They built similar joint ventures (like SolGold in Ecuador, or their past Copper streams) expecting hiccups. Investors with 5-10 year horizons can afford to tolerate a year or two of deal execution woes. After all, the alternative is stagnation. Shying away from risk in mining means staying small.

The Case for Patience and Conviction

As I step back from the details, a broader question emerges: What does this tell us about investing today? In an era where hedge funds and algorithms chase quarterly statements, here are two old miners backing a multi-decade conviction. It’s a deeply contrarian act. Betting on a 12-18 month regulatory timeline (if nothing else) requires patience, and even beyond that it’s a 10-year vision.

The Anglo Teck merger seems to say: the future trajectory of copper matters more than any short-term noise. You could almost see this as the investing equivalent of planting an oak tree under whose shade our grandchildren might sit. And in that sense, this deal might reward exactly the kind of contrarian mindset needed to ensure excellent performance. Anglo Teck emerges as a fusion of optimistic (they believe energy transition will need copper) and skeptical (they don’t trust that building from scratch is fast enough).

I also recall something Peter Lynch paraphrased: “Often, the stocks of wonderful companies eventually become wonderful companies.” Here, the worry of many was that miners were running out of growth. Instead, a “wonderful” thing has happened: they married to double the firepower. As Warren Buffett said elsewhere, “Someone's sitting in the shade today because someone planted a tree a long time ago.” Anglo and Teck are very much planting a tree here, even if the benefits won’t fully bloom for years.

There are deeper lessons too. George Soros is famous for saying that “It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right.” This merger is a bet with a lot at stake. If they are right about copper’s structural bull market, the returns could be enormous. If they misjudge, the bill is high. But that’s the calculus of long-cycle, high-conviction investing. It’s explicitly not about playing it safe.

Right now, sentiment in mining is mixed. Many companies have become conservative cash cows after the last supercycle. Breakups, spin-offs, share buybacks – all prevalent. Real hard-eyed bets are rare.

So Anglo Teck shouts confidence. I for one will be sitting up, with popcorn ready, to see how this plays out. Anglo American and Teck have put their thoughts into action.

“He who cannot put his thoughts into action is a miserable creature.” - Nietzsche

As contrarian investors, maybe we should cheer on this kind of audacity. If copper truly powers our low-carbon future, then something like this is the right move – one of the few moves big enough to matter. If short-term markets balk, well, that’s the contrarian’s feast. As Templeton also reminded us, “The four most expensive words in the English language are: This time it’s different.” This merger might feel “different,” but maybe in fact it acknowledges that this time the fundamentals really are different – and we’d be fools not to adjust our portfolios accordingly.

In the end, I find myself oddly uplifted. Amid an investment landscape of twitchy traders and quarterly whispers, Anglo American and Teck have chosen conviction over caution. It may yet be remembered as one of the great contrarian gambles of the commodities era. As investors, that’s the narrative where we often make the most money: looking down when others look up, and sowing when others are reaping. If the copper bull runs longer than anyone expects, Anglo Teck’s story will be a legend of patient, courageous investing.