Killing Debt, Buying Drills - a Junior Miner Stock Analysis

From its flagship Segilola mine in Nigeria to the vast potential of the Douta project in Senegal and exploration projects in Côte d'Ivoire and lithium, Thor is a multi-jurisdictional, multi-commodity.

It is common to buy stocks at 52-week lows and label oneself a contrarian investor.

Unfortunately, this deeply misses the point of contrarian investing. True contrarianism is not just about going against the herd; it is about seeing value where the crowd is blind, understanding the why behind the discount, and possessing the conviction to act when others hesitate.

It is paradoxical that contrarianism is widely accepted as the hallmark of an intelligent investor, yet few truly grasp what it takes to be one, or else being one would not still offer such mouth-watering returns.

Thor Explorations is one of these situations.

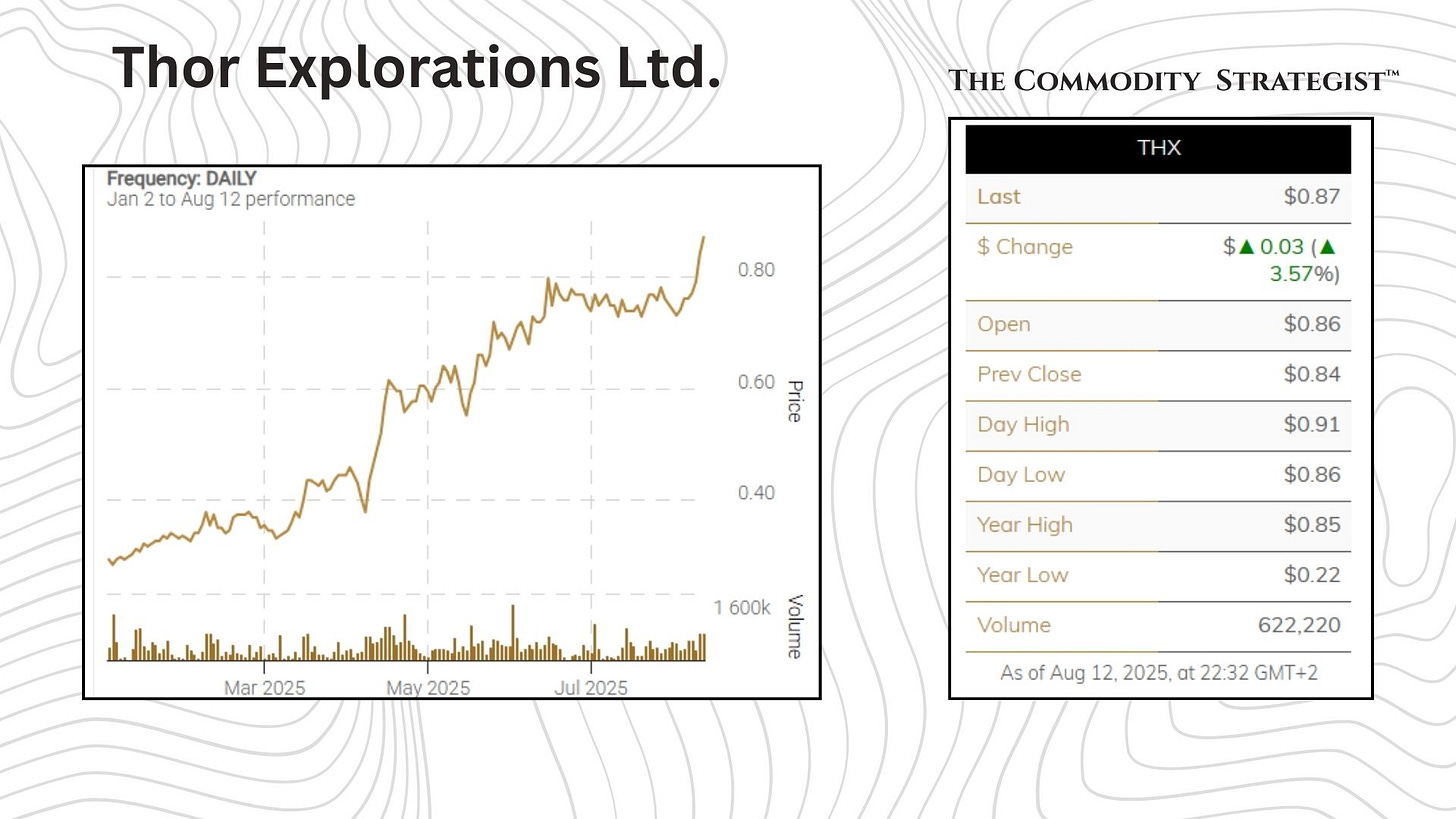

Thor Explorations Ltd. is not your typical junior miner; it stands as a Profitable, cash flow generative, deleveraged entity with a sharp focus on West Africa's gold. The company is listed on both the TSX Venture Exchange (THX: TSX-V) and the Alternative Investment Market of the LSE (THX: AIM). It #has a Market Cap of $405.33 million, with a P/E Ratio of 2.95.

Since completing its Segilola Gold Mine in Nigeria in late 2021, this company has established a consistent track record of production, with over 84,000 ounces of gold produced annually for the last three years. This is a foundational asset that has positioned them as a leader in a new frontier.

Segilola is Nigeria's first and only large-scale commercial gold mine. It's a key advantage in a region of West Africa that's still largely unexplored. The mine was built on a probable reserve of over 517,000 ounces of gold, and initial exploration is already revealing even more gold beneath the existing pit.

But the real story is what's happening beyond this cornerstone project. The company has secured an impressive exploration portfolio, covering more than 1,300 square kilometers of promising gold-bearing land in the region.

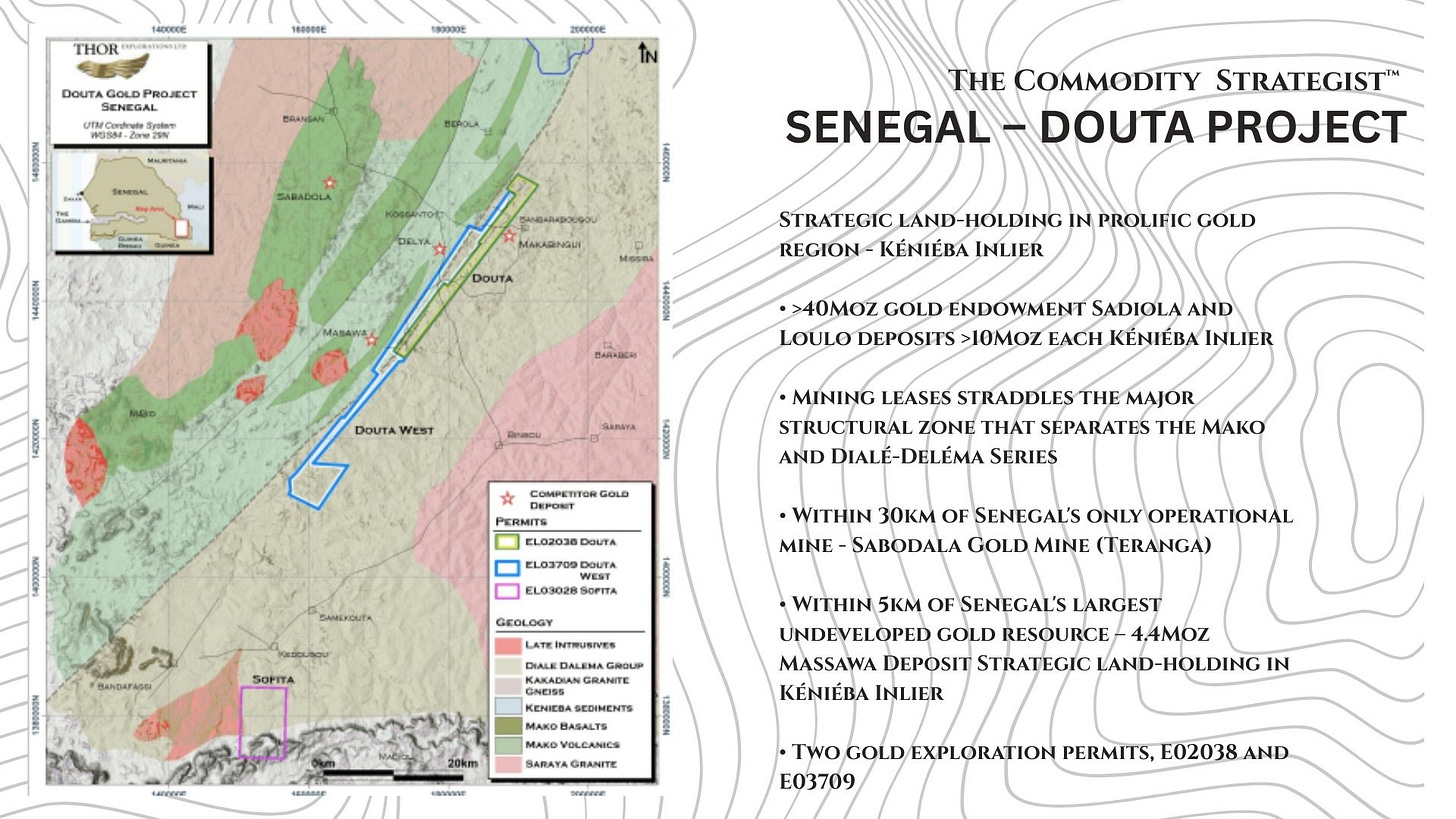

This growth strategy extends across borders. The company holds a 70% stake in the Douta Gold Project in Senegal, a high-potential asset with a resource estimate of 1.78 million ounces. Drilling continues to show high-grade intersections, and the company is moving forward with a Preliminary Feasibility Study.

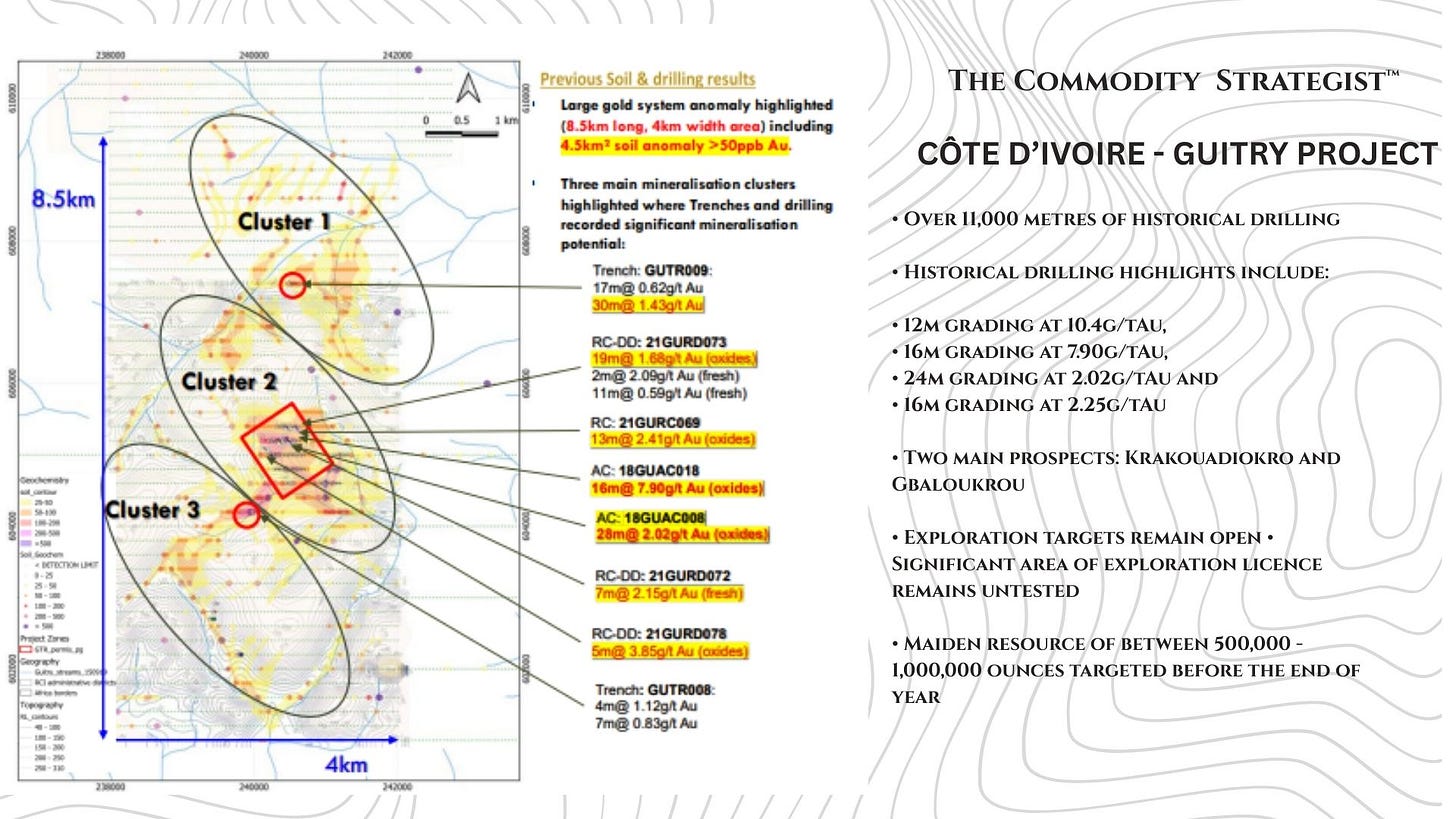

Furthermore, it's expanding into Côte d'Ivoire, where it has recently acquired a 100% interest in the Guitry Gold Project and secured options on two other exploration licenses, Marahui and Boundiali, to earn up to an 80% interest.

Let’s Get into it.

The foundation of Thor's current operational capabilities and its trajectory for future expansion rests firmly upon its flagship producing Segilola Gold Mine in Nigeria and the advanced staged, Douta Gold Project in Senegal. These two assets form the core of the company's value proposition, with each contributing distinct opportunities for growth and profitability.

However, Thor is actively diversifying their portfolio. This expansion includes new gold ventures in Côte d'Ivoire and an entry into Nigeria's lithium potential.

By diversifying into new gold projects within another gold-producing region, Côte d'Ivoire, and simultaneously venturing into a distinct, high-growth commodity like lithium in Nigeria, Thor is constructing a more resilient long term strategy.

Lithium provides the company with exposure to a rapidly expanding sector, offering a potentially significant value driver that is independent of gold price movements. This diversification provides invaluable optionality, a characteristic frequently undervalued by the broader market, as it allows the company to capitalize on multiple growth avenues and mitigate concentrated risks.

Segilola – Beyond the Consistency

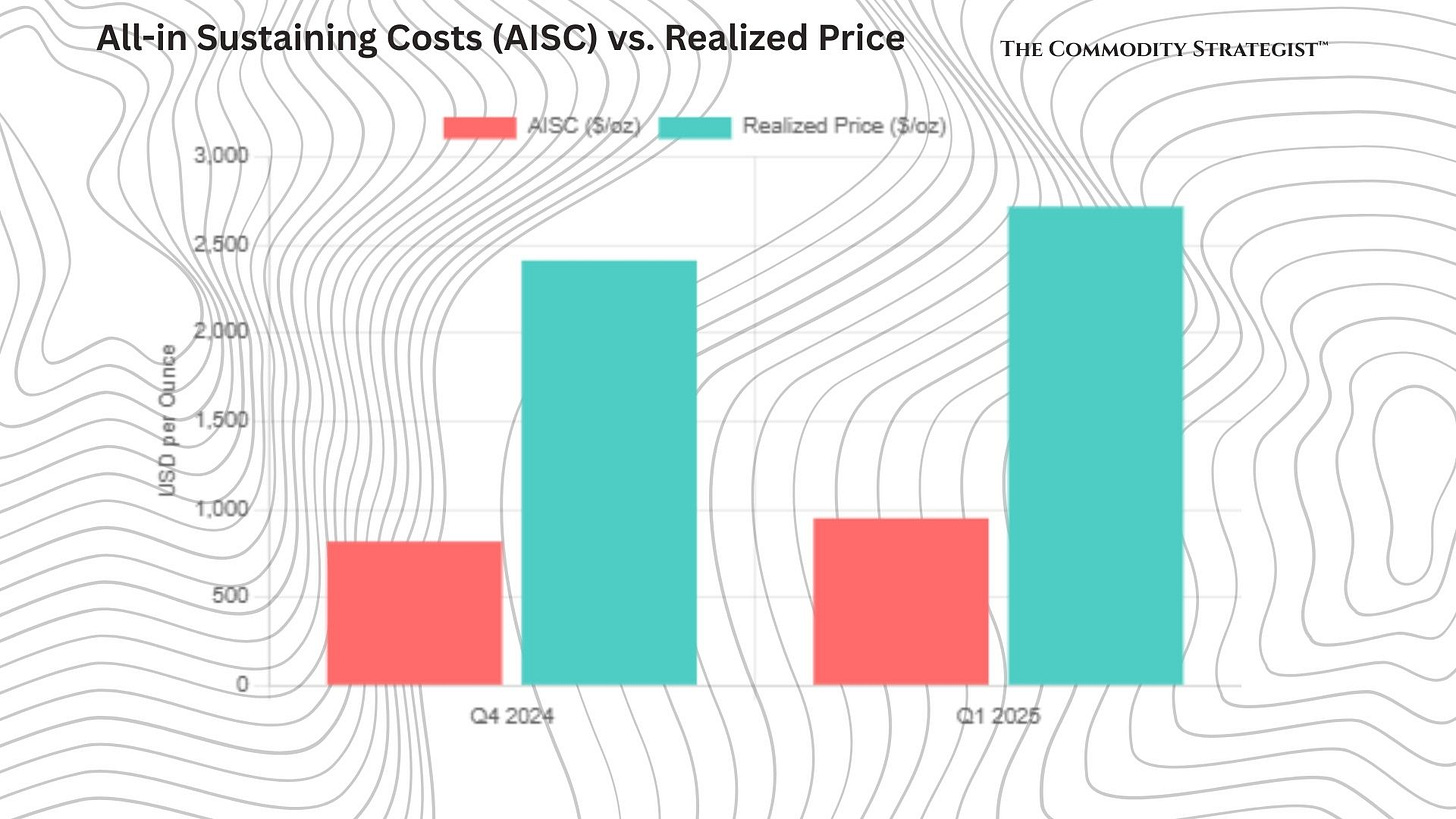

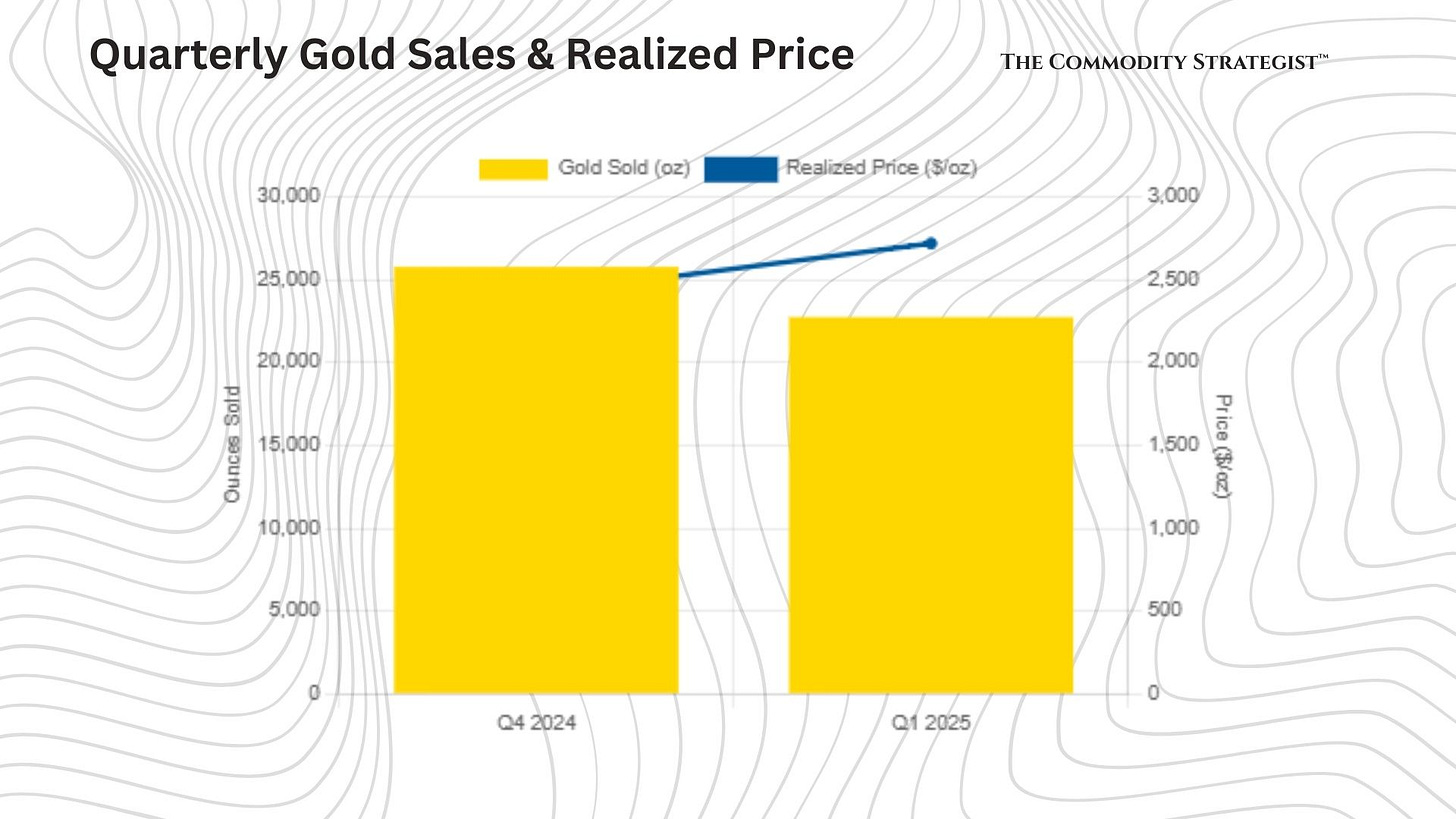

Segilola, Thor's wholly-owned flagship operation in Nigeria, has consistently demonstrated its operational capability. In 2024, the mine achieved a gold production of approximately 85,000 ounces, contributing to a revenue of $193.1 million from 84,965 ounces sold at an average realized price of $2,288 per ounce. This strong performance culminated in a significant Group net profit of $91.2 million. The outlook for 2025 projects continued strong performance, with guidance set at 85,000 to 95,000 ounces at an All-in Sustaining Cost (AISC) of $800-$1,000 per ounce, signaling management's confidence in sustained profitability.

The fourth quarter of 2024 saw the mine sell 25,790 ounces of gold at an impressive average realized price of $2,414 per ounce, with cash operating costs maintained at $664 per ounce and AISC at $818 per ounce, underscoring effective cost management. This positive trend continued into the first quarter of 2025, where Segilola sold 22,750 ounces at an even higher average realized price of $2,720 per ounce, although cash operating costs rose slightly to $711 per ounce and AISC to $950 per ounce.

Mining operations in Q4 2024 experienced some impact from severe weather conditions, including over 415mm of rain in a 12-day period, and challenges posed by an aging contractor fleet. In response, the company proactively purchased five new trucks and scheduled excavator overhauls for early 2025. Despite these factors, the mine successfully delivered 383,699 tonnes of ore at an improved average grade of 2.30g/t. Q1 2025 saw a slight reduction in mining rates but an increase in average grade to 2.42g/t. Processing efficiency remained high, achieving 89.2% recovery in Q4 2024 and an improved 93.7% in Q1 2025, without significant downtime, highlighting the operational stability of the plant.

The consistent ability of Segilola to maintain production and profitability, even when confronted with external adversities like severe weather and internal adjustments such as managing an aging equipment fleet, profoundly demonstrates the underlying operational resilience and the effectiveness of its management team.

Stockpiling Strategy

A notable operational advantage for Segilola is its substantial ore stockpile. This strategic asset grew by 10% in Q4 2024, reaching 1.47 million tonnes at an average grade of 0.94g/t, representing over a year of process plant supply. Although it experienced a slight reduction in Q1 2025 to 41,399 ounces (equivalent to 1.3 million tonnes) at 0.84g/t. This stockpile enables the mine to preferentially feed higher-grade material to the mill, thereby optimizing processing performance, while reserving lower-grade ore for later in the mine life or for periods of reduced mining activity.

The strategic stockpile functions as a means of de-risking production and optimizing the mill feed. Inherent variability in mining operations, ranging from equipment downtime to adverse weather conditions, can cause significant fluctuations in ore availability and grade. A large, well-managed stockpile ensures that the processing plant can maintain consistent throughput and feed grade, even if mining activities encounter temporary setbacks. This operational flexibility smooths out production metrics, helps control unit costs by ensuring consistent utilization of the mill, and allows for strategic blending of ore to optimize gold recovery. All these factors directly contribute to more predictable and higher-margin cash flows, making the stockpile an underappreciated asset on the balance sheet.

Extension of Life of Mine

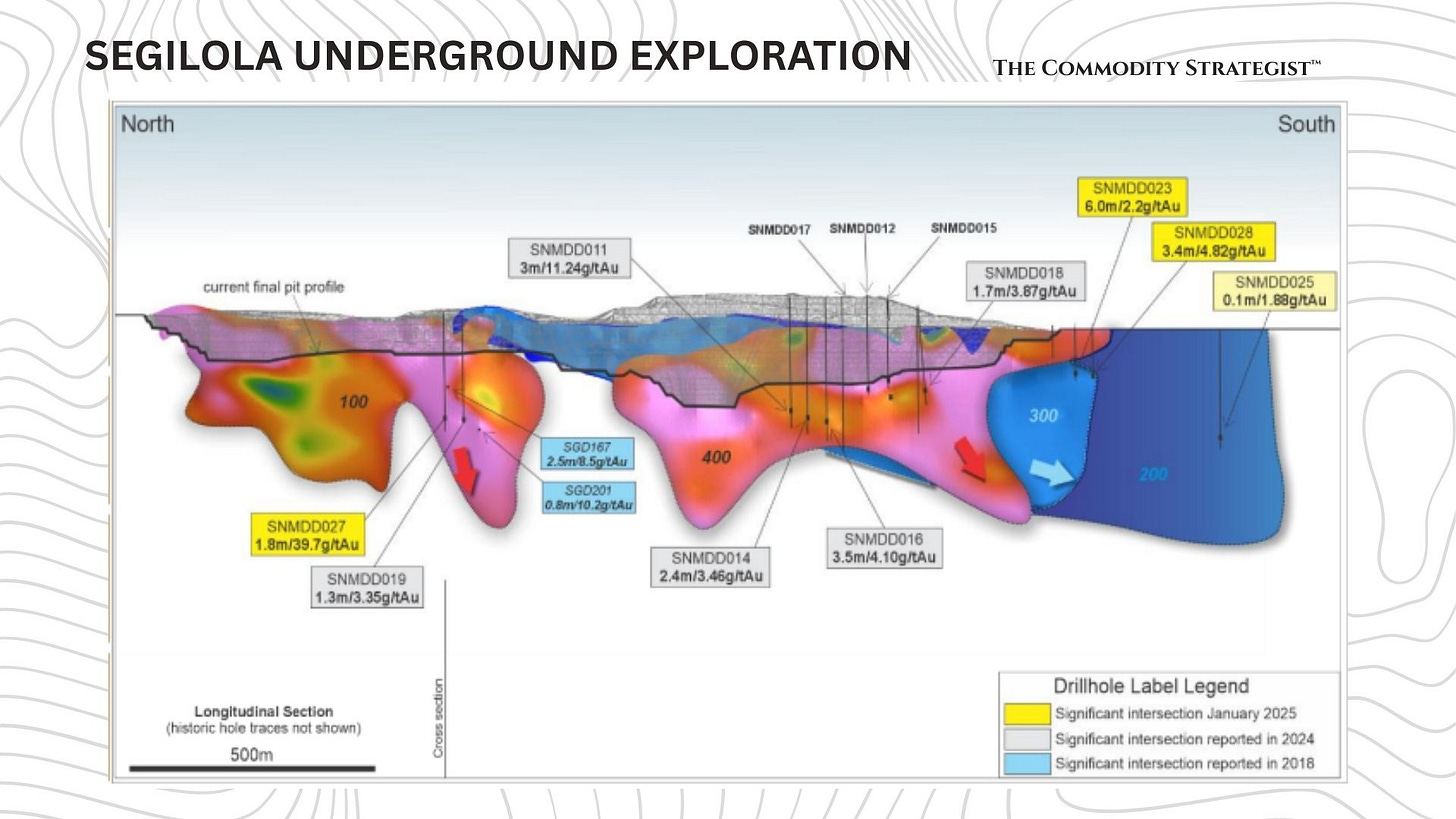

The original Definitive Feasibility Study (DFS) for Segilola, released in May 2021, projected a Life of Mine (LOM) of approximately 5.5 years, encompassing four years of open pit mining followed by an additional 14 months of processing, with an estimated recovery of 502,000 ounces of gold. Extending this LOM is as Thor's utmost priority. To achieve this, a diamond drilling program is actively underway, testing the depth extensions of the Segilola deposits, with the objective of delivering an updated mine plan by the end of 2025.

Initial results from this drilling program have shown promise, with intersections such as 3.0 meters at 11.24g/t Au approximately 50 meters below the current final pit design, and 1.8 meters at 39.7g/t Au, suggesting the potential for high-grade shoots at depth. In a strategic move to enhance cost control and accelerate drilling progress, Thor has acquired its own drilling rigs, signaling a long-term commitment to this objective.

Thor's aggressive and self-funded drilling program directly addresses this critical investor concern. Investors frequently apply a discount to single-asset mines due to the perceived finite nature of their operations. By prioritizing and funding the extension of the mine life, including the acquisition of its own drilling rigs for efficiency, Thor is actively converting existing inferred resources and identified potential into future reserves. This approach paves the way for substantial future value creation beyond the initial DFS projections, effectively transforming the narrative from a finite operation into one with significant growth prospects.

Douta Gold Project

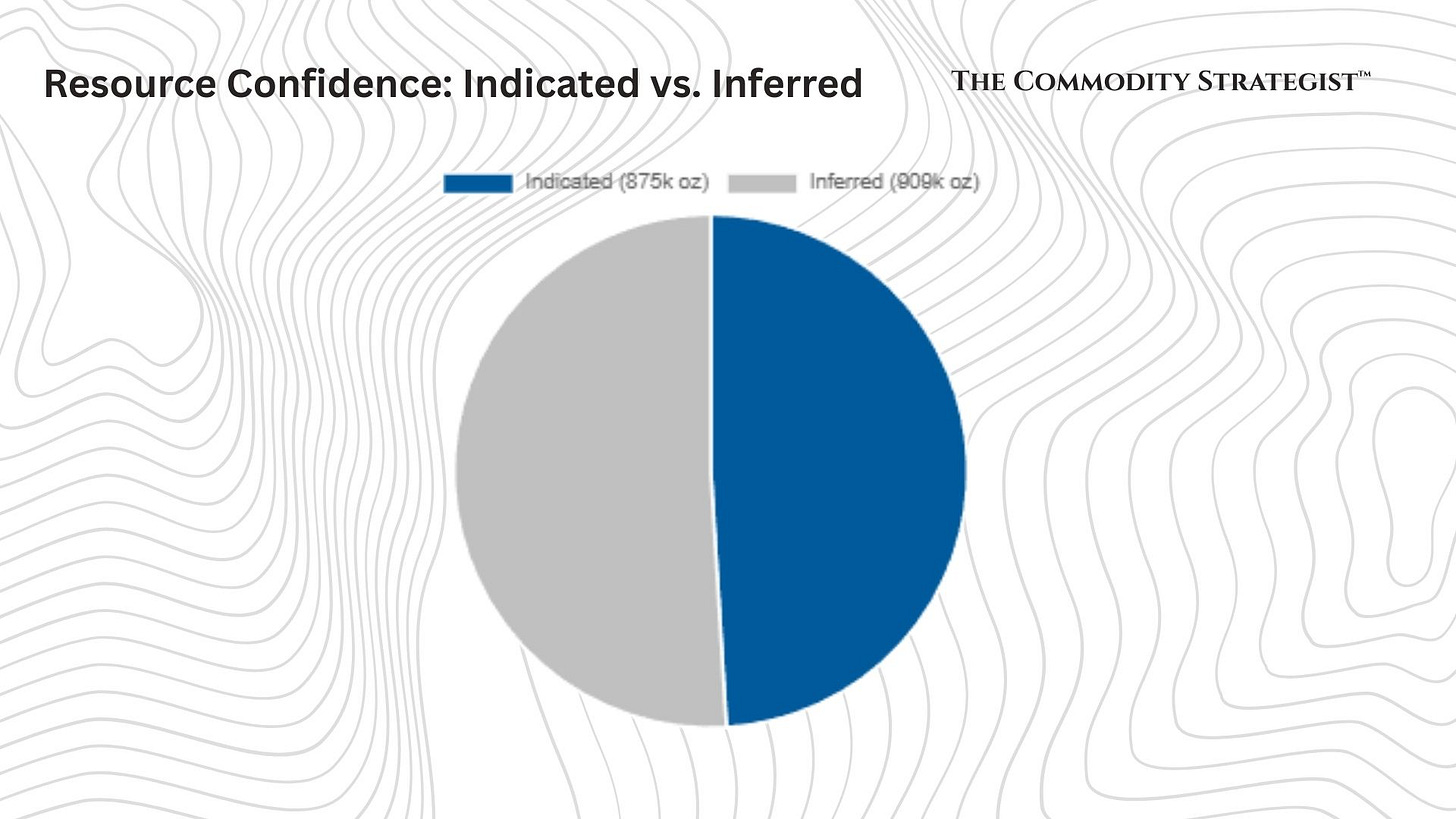

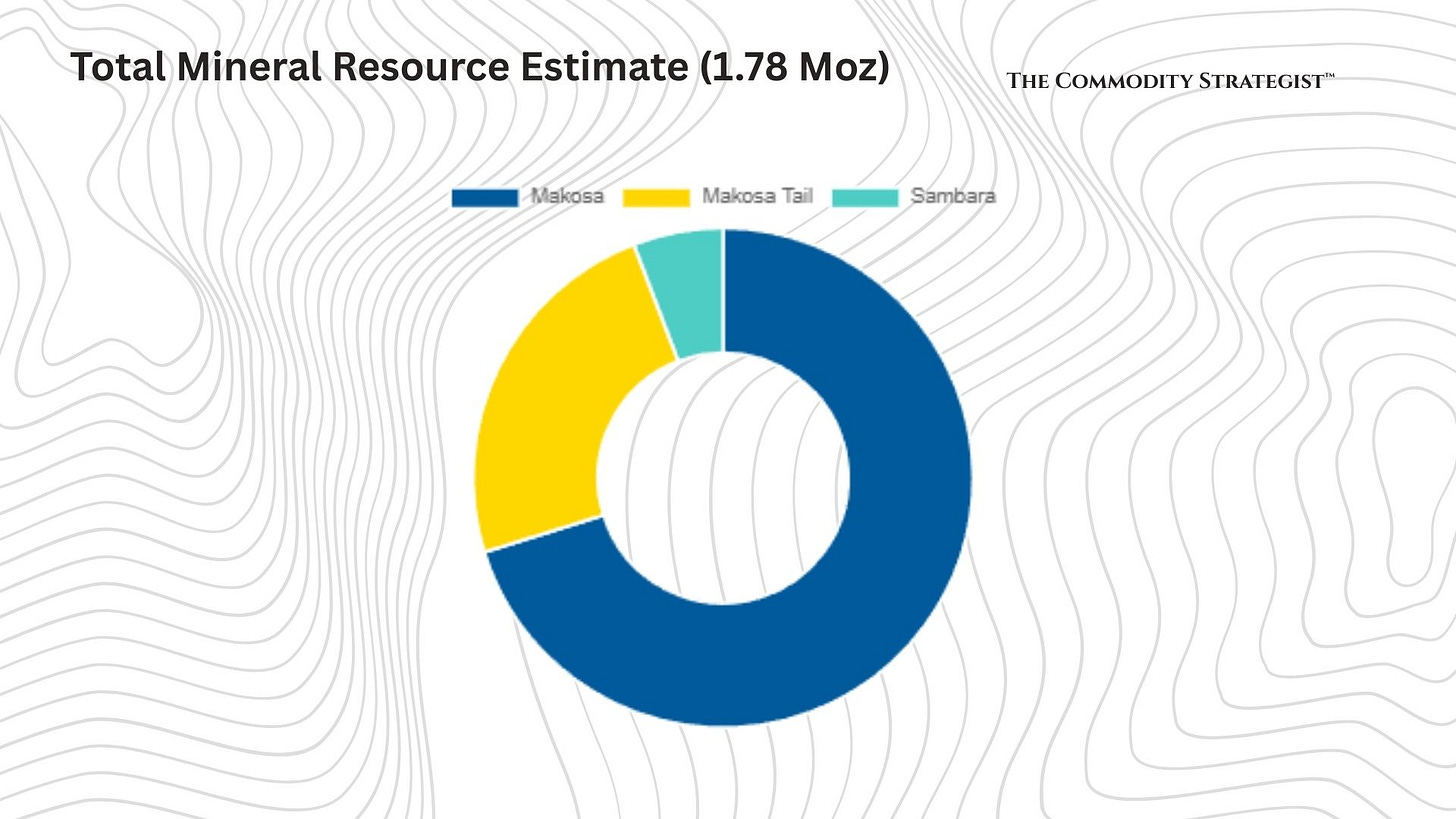

The Douta Gold Project in Senegal boasts a significantly upgraded Mineral Resource Estimate (MRE) as of March 2023. This MRE, prepared by MineralMind in accordance with NI 43-101, outlines a total of 45.3 million tonnes (Mt) grading 1.3g/t Au for a substantial 1.78 million ounces (Moz) of gold. The estimate includes 874,900 ounces in the Indicated category (20.18Mt @ 1.34g/t Au) and 909,400 ounces in the Inferred category (24.09Mt @ 1.17g/t Au).

The resource is constrained within optimized pit shells based on a $2,000/oz gold price and a 0.5g/t Au cut-off, indicating reasonable prospects for economic extraction by open pit methods. Thor holds a 70% economic interest in the project, with the remaining 30% being free-carried until a Probable Reserve is formally announced.

The near-doubling of the Douta resource from 730,000 ounces in 2021 to 1.78 million ounces in 2023, coupled with the significant upgrade to Indicated classification, represents a substantial de-risking event that the market may not have fully appreciated. Such a considerable increase in resource size, particularly the conversion of Inferred to Indicated resources, dramatically enhances geological confidence. This de-risks the project, making it considerably more attractive for development funding and potentially leading to a higher valuation. The market often exhibits a lag in fully incorporating such fundamental, yet technical, resource upgrades into a company's share price.

Path to Feasibility

Progress on the Preliminary Feasibility Study (PFS) for Douta commenced in 2024, with a focus on critical workstreams such as metallurgical test work, process flow sheets, and resource updates. While mineral reserves have not yet been formally defined, the fact that the resource is already constrained by optimized pit shells represents a crucial step towards demonstrating economic viability and future mine planning.

Initial metallurgical tests have shown promising results, indicating approximately 91% recovery for oxide material using conventional gravity/CIL methods, which is a positive indicator. However, fresh and transitional material appears to be more refractory, necessitating further optimization efforts. Thor is proactively addressing this by using 88-90% recovery factors from the nearby Massawa deposit as a placeholder for pit optimization, demonstrating a pragmatic approach to project development.

The transparency regarding the metallurgical complexity of the fresh ore, combined with Thor's proactive approach (benchmarking against a successful nearby mine like Massawa and committing to ongoing test work) demonstrates a strong dedication to identifying and implementing a viable processing solution rather than overlooking a potential obstacle. This strategy builds confidence in the eventual outcomes of the Preliminary Feasibility Study and significantly reduces the likelihood of unforeseen cost overruns or delays later in the development timeline.

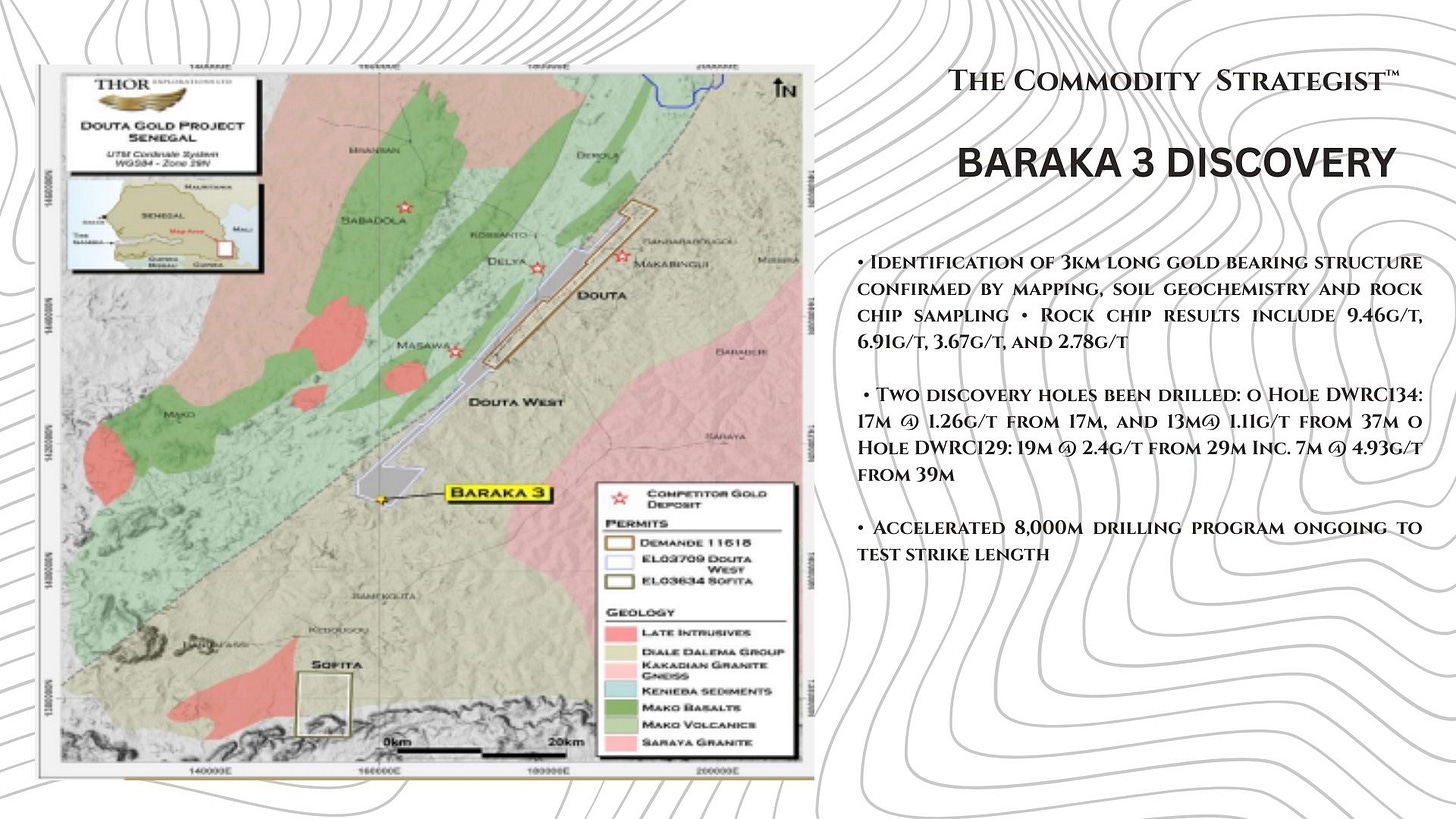

Baraka 3 Discovery

Thor strategically expanded the Douta Project by acquiring the contiguous Douta-West licence (E03709) in 2024, located immediately south of the existing Douta licence. Recent drilling at the Baraka 3 Prospect within Douta-West has yielded significant discoveries, including 19 meters at 2.46g/t Au from 29 meters and 26 meters at 1.31g/t Au from 21 meters, delineating a wide, near-surface oxide layer.

This has prompted an accelerated 12,000-meter drilling program, as Thor believes Douta-West could present a new, significant source of early-years production, potentially enhancing the economics of the Douta PFS. This development may even lead to a temporary delay in the PFS completion as the new, impactful data is incorporated, a strategic choice prioritizing long-term value over immediate study completion.

The discovery of a "thicker oxidised layer" at Baraka 3 represents a potentially transformative development for the Douta project. Oxidized ore is typically softer and less abrasive than fresh rock, which translates directly into lower mining costs due to reduced drilling, blasting, and hauling requirements. Crucially, it is also significantly less complex and capital-intensive to process, generally requiring conventional Carbon-in-Leach (CIL) methods rather than more expensive refractory solutions. If Baraka 3 can provide a substantial volume of early-stage oxide feed, it will dramatically front-load cash flows, reduce initial capital expenditure, and significantly improve the project's Net Present Value (NPV) and Internal Rate of Return (IRR). This means that any "delay" in the Preliminary Feasibility Study completion, while potentially perceived negatively by the market in the short term, is in fact a strategic advantage. This scenario presents a classic contrarian opportunity: discerning a "delay" as a clear indicator of greater future value.

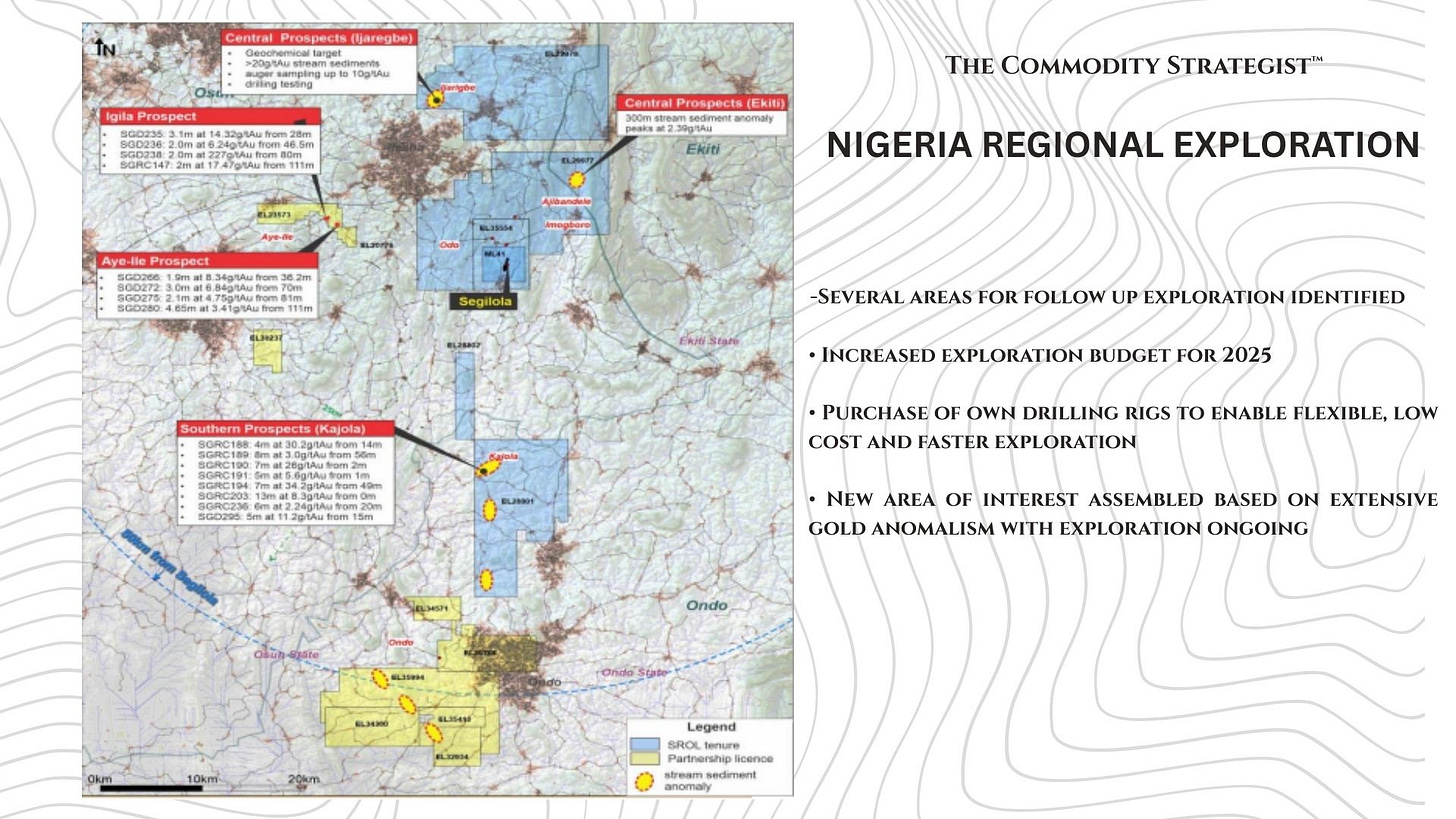

Other Nigerian Assets

Thor's Nigerian portfolio extends significantly beyond the Segilola mining lease, encompassing a vast and prospective land package. This includes 16 wholly-owned and 13 joint venture or option exploration licenses, totaling an impressive 1,697 km² of gold exploration tenure. Regional exploration efforts are strategically focused, with approximately 80% concentrated within a 25km radius of Segilola. This approach aims to identify new gold material that can be efficiently trucked to the existing processing plant, thereby significantly leveraging existing infrastructure. More generative exploration is also targeting new standalone operations further afield.

Significant gold anomalism has already been identified, including the high-grade Kajola target, located 20km from Segilola, with intersections such as 11m grading 22g/t Au. New targets like Owode, situated south of Kajola, are slated for RC drilling in May 2025

In a forward-thinking move, Thor, through its subsidiary Newstar Minerals Ltd., holds over 600 km² of lithium tenure across Oyo, Kwara, and Ekiti states. This includes what the company considers Nigeria's "most significant lithium pegmatite occurrence" , positioning the company in a critical future-facing commodity. Exploration is actively underway to define drill targets, with scout drilling planned for June 2025 in the Ondo State lithium project.

Thor's aggressive regional exploration strategy in Nigeria, particularly in areas proximal to Segilola, represents a highly capital-efficient approach to growth. Expanding the resource base around an existing mill is one of the most cost-effective methods for increasing production and extending mine life, as it significantly reduces the need for future capital expenditure associated with new plant construction and accelerates payback periods. The high-grade intercepts already identified indicate substantial potential for new discoveries that can feed directly into the current operation. Furthermore, the early-stage lithium venture strategically positions Thor in a critical future-facing commodity market.

Cote d’Ivoire

In 2024, Thor strategically expanded its operational footprint into Côte d'Ivoire, a major and highly prospective West African gold jurisdiction. This expansion includes the acquisition of a 100% interest in the Guitry Gold Project from Endeavour Mining, and securing option agreements for 80% interests in both the Boundiali and Marahui exploration permits. Initial exploration activities are actively underway across these newly acquired assets, with drilling programs planned for Guitry in Q2 2025 and Marahui in Q3 2025, indicating a rapid progression from acquisition to on-the-ground work

Entering Côte d'Ivoirethrough acquisitions that include assets from a major mining company like Endeavour Mining, provides Thor with access to high-quality, de-risked early-stage assets. By expanding into Côte d'Ivoire, acquiring projects from a major mining company shows a degree of prior due diligence and inherent geological prospectivity, offering a more powerful starting point for exploration compared to pure greenfield ventures. This approach can potentially accelerate the path to discovery and development.

The combined effect of these aggressive exploration and acquisition initiatives across diverse commodities and geographies fundamentally transforms Thor from a single-mine gold producer into a diversified West African growth story with multiple potential catalysts. Should one project encounter unforeseen challenges, others within the portfolio can absorb the impact, providing a built-in resilience.

The market often struggles to accurately assign value to this inherent "optionality" until it visibly materializes, thereby creating a fertile ground for contrarian investors who can recognize this latent potential.

Balance Sheet Transformation

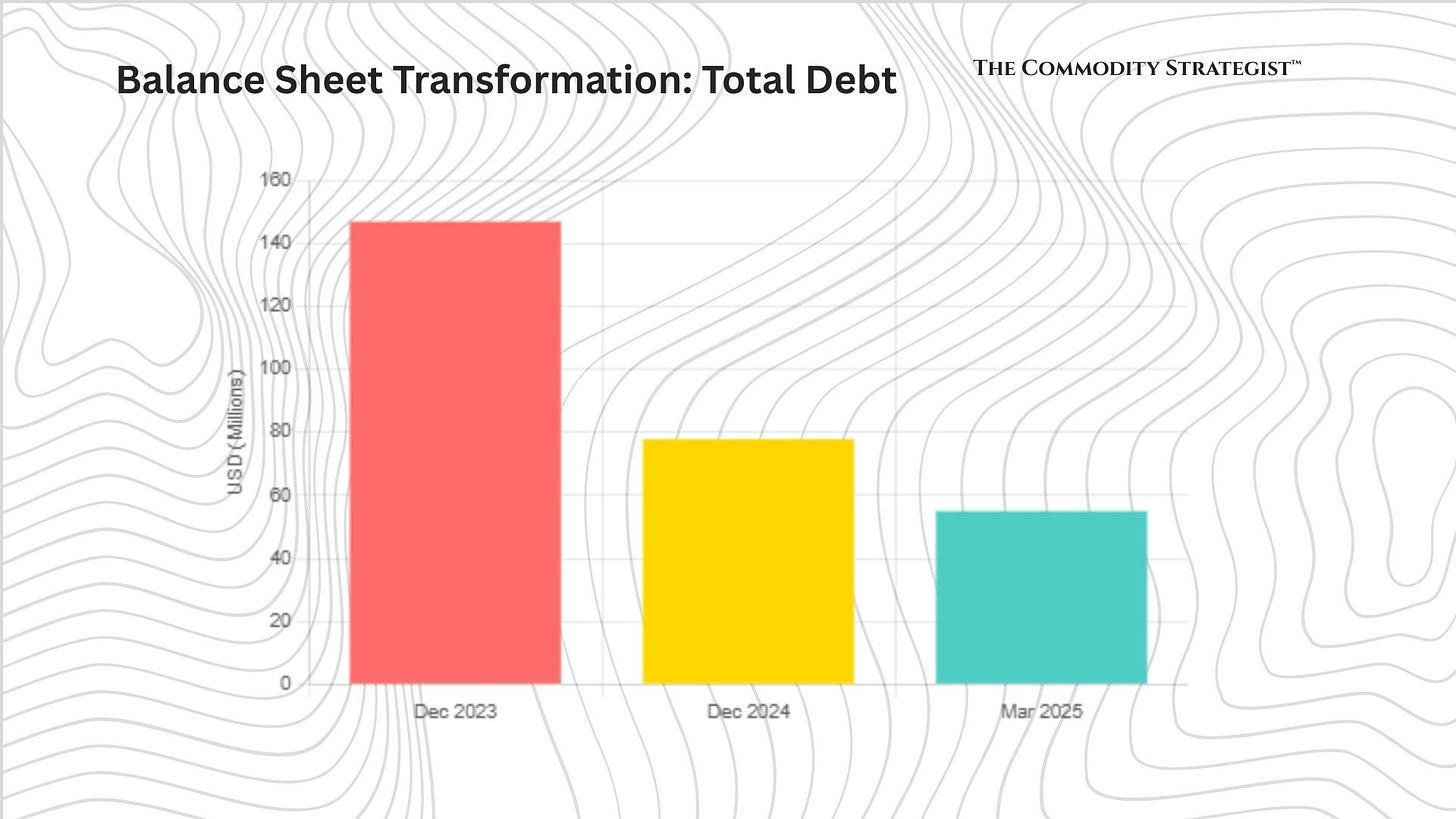

Thor's financial journey through 2024 and into Q1 2025 is a masterclass in balance sheet transformation, a narrative that often goes unnoticed amidst the daily market noise. The Group has transitioned from a net debt position of $(15,926) million at December 31, 2023, to a robust net cash position of $11.2 million by December 31, 2024. This remarkable deleveraging was primarily driven by the full repayment of its senior debt facility to the Africa Finance Corporation (AFC) in Q4 2024.

By March 31, 2025, the cash position further surged to an impressive $24.758 million, and all remaining loans and borrowings, including the deferred element of the EPC contract for Segilola's construction, were fully repaid. The gold stream liability, a commitment of future gold production, also saw a significant reduction from $20.043 million at the beginning of 2024 to $5.181 million by March 31, 2025, further freeing up future gold production for unencumbered sale. Total liabilities plummeted from $146.920 million in 2023 to $77.819 million in 2024.

The significance of this deleveraging and the resulting enhancement in financial strength cannot be overstated. By systematically reducing its debt burden, Thor Explorations has effectively freed up a substantial portion of its operating cash flow. This liberated capital is no longer allocated to servicing high-interest debt obligations, but can now be strategically re-invested into growth initiatives, such as accelerated exploration programs and project development. This improved financial posture not only reduces the company's financial risk profile, making it more resilient to market fluctuations, but also enhances its attractiveness to a broader spectrum of investors who prioritize balance sheet strength and the capacity for self-funded expansion.

Thor Explorations Ltd. is a company that has systematically de-risked its operations, expanded its resource base, diversified its portfolio, and fundamentally transformed its financial position. Yet, its true value may remain obscured by generalized market perceptions of West African mining. For the discerning investor, willing to look beyond the headlines and embrace the essence of contrarian thought, Thor Explorations might just be the unseen opportunity waiting to be fully recognized.