Caesium’s Power Grab: The Metal Worth More Than Gold

Caesium: About, Applications, Market Drivers, Challenges, Trends and Geopolitical Tensions.

Background

What is Caesium? Caesium is a chemical element; it has symbol Cs and atomic number 55. It is a soft silvery-golden alkali metal with a melting point of 28.5oC, which makes it one of only five elemental metals that are liquid or near at room temperature. The Caesium bearing mineral is pollucite. Pollucite - which contains about 20% Caesium also has value as a mineral specimen and as a gem.

Annual global gold production is about 100 times larger than Caesium production. But it isn’t just a niche metal used for scientific experiments, Caesium has quickly become the backbone of extremely precise time keeping, quantum computing, and the new generation of telecommunications. The emphasis of this metal however is on its critical role in the worlds most advanced atomic clocks (an extremely accurate type of clock which is regulated by the vibrations of an atomic or molecular system) as well as its role in GPS, secure communication networks, and even military defence technologies.

Meanwhile, as China has been taking the market share of rare earth minerals with the U.S trying to keep up, Caesium’s scarcity has turned into a strategic play. With Canada’s deposits and Kazakhstan and Mozambique’s new hidden reserves, the global interest in this rare metal is intensifying.

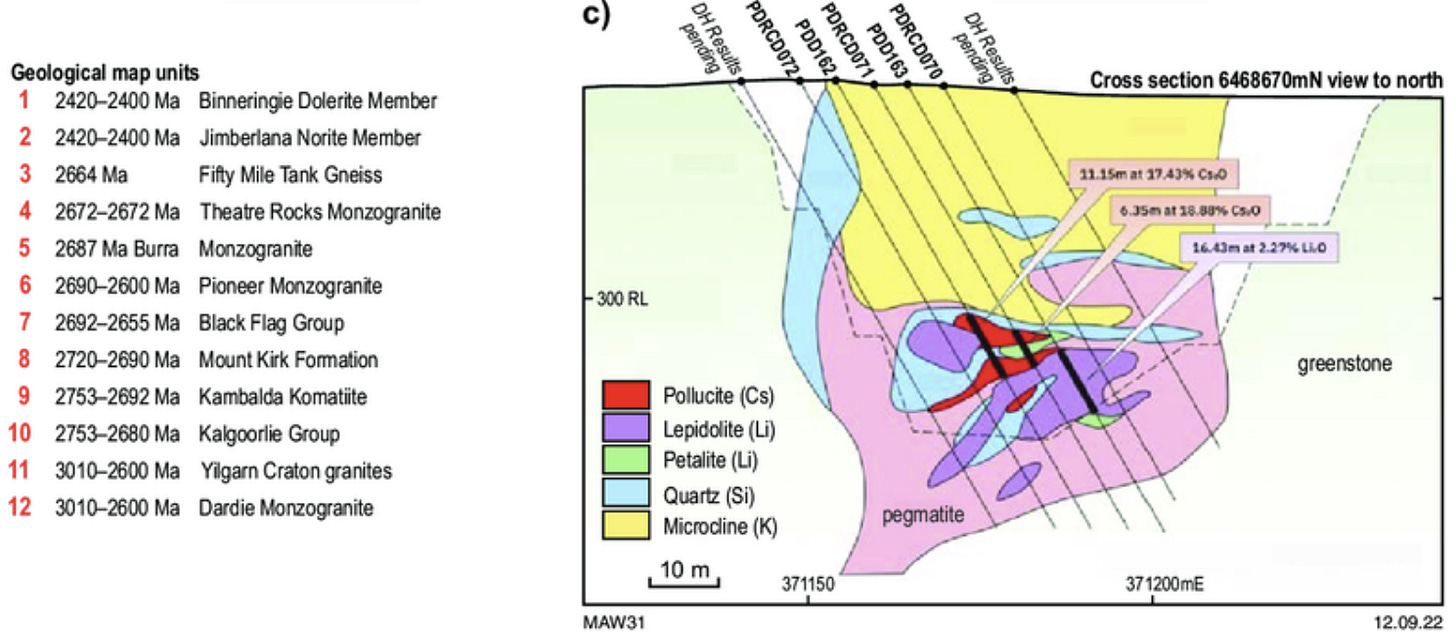

At the same time, Australia’s Pioneer Resources (ASX:PIO), a mining giant is aggressively expanding its Caesium production. By increasing mining intensity and efforts, the company is attempting to shift the balance of Caesium supply away from China’s dominance - which could create a shift in the global Caesium market, offering the West a crucial alternative to China’s near-monopoly.

Rare Alkali metals

Powering Atomic Clocks, Quantum Technology, and Industry Applications

The market for Caesium is expanding steadily as a result of its uses in a number of industries. A recent breakthrough with powering atomic clocks and quantum technology has made Caesium no longer a scientific curiosity but a really practical part of modern technology. The metal is playing a crucial role in the latest generation of atomic clocks, which are so precise that they lose only one second every 30 billion years. These clocks are essential for everything, for example, in synchronizing the global financial system or enabling ultra-secure military communications. This is expanding the market steadily.

Caesium is also used extensively in radation therapy, industrial radiography, and environmental research as a tracer. Due to its usage as a dependable source of radation in the treatment of cancer, Caesium is in high demand. The market is also growing as a result of the increasing need for nuclear energy, improvements in scientific research, and environmental monitoring. In the medical industry, Caesium gives tumours accurate radiation dosages, so it’s widely employed in radiation therapy to treat cancer.

The recent development of optical lattice clocks, which are next-generation atomic clocks that use ultracold neutral (strontium and ytterbium) atoms confined in a 3D optical lattice to create a highly precise time measurement, powered by Caesium, has pushed precision time keeping to unprecedented levels. This is allowing advancements in satellite navigation, 6G networks, and deep-space exploration. And as nations are investing heavily in AI and quantum computing, Caesium’s role in stabilizing time-sensitive data processing will grow significantly.

Since the supply is so small, with about one company controlling 90% of the supply, major tech firms and defence contractors are lobbying for increased Caesium production. North American companies, including Canada-based Power Metals Corp, are ramping up exploration efforts, recognizing Caesium as a critical element in the technological arms race.

Market - Drivers, Challenges, Trends

The Caesium Market size was valued at $42.4Bn in 2024 and is expected to reach $61.1Bn by 2032, growing at 3.8% CAGR from 2025 to 2032.

Drivers

There are four main market drivers for Caesium. There is a growing use in medical applications, the market demand is driven by its extensive use in medical treatments aforementioned. There is a growing adoption in industrial applications, Caesium is used in density gauges and industrial radiography, which increases demand for it in industries including manufacturing and construction. A growing need for radiological research is also driving its growth, as its used in environmental and radiological research. Caesium is also frequently utilised in food preservation through irradiation, especially in emerging markets.

Challenges

Safety and regulatory concerns make it difficult for the sector to expand, such as tight laws governing the transportation, handling, and disposal of radioactive materials. Secondly, health dangers and environmental hazards raises concerns. Additionally, its high cost and limited availability impacts the markets acceptance of Caesium, affecting the marketability and price stability of the metal. Finally, the competition from alternative isotopes such as Cobalt-60 used are frequently favoured in specific applications.

Trends

Growth of nuclear and power generation industries requires Caesium in a variety of safety and diagnostic applications. The emphasis on sustainable isotope management in order to promote sustainable business practices means that initiatives are being made to enhance the recycling and reuse of radioactive isotopes such as Caesium. Additionally, the growing research in alternative treatment methods is impacting Caesium as the expansion is into non-radioactive substitutes for industrial medicinal purposes. However, the technological developments in radiation detection is improving the safe application of Caesium (by developments in safety and radiation detection technology).

Caesium’s Concentrated Supply: The U.S. and China Power Struggle Intensifies

With only around 5 known economically viable Caesium deposits worldwide, geopolitical tensions over its supply are escalating. China controls the bulk (90%) of the worlds Caesium reserves through its state-backed mining operations in Africa and Central Asia. Meanwhile, the United States has been trying to secure alternative sources, with Caesium officially declared as a critical mineral by the Department of Defence.

The United States has virtually no domestic Caesium production, relying almost entirely on imports from China, Kazakhstan and Canada. The recent push for resource independence has led to increased interest in mining operations in Canada’s Tanco Mine, the world’s most significant Caesium producing cite. Pioneer Resources (ASX:PIO), an Australian mining company, is expanding efforts in the Sinclair Zone, a rare Caesium-bearing deposit.

However, Chinese firms have also been acquiring stakes in key Caesium assets worldwide, trying to ensure their continued dominance. This creates a risk for the United States as if China restricts exports (similar to its past moves with rare earth elements) the U.S. could face severe disruption in everything from satellite networks to national security infrastructure. This makes Caesium a high-stake bargaining chip with nations. Who ever can control the supply can significantly change the course of their nation’s technological and scientific development.

Caesium’s Premium Pricing: Worth More Than Gold

Caesium’s extreme rarity and specialised applications make it one of the most expensive metals on Earth, as of 2020, the most expensive non-synthetic element by both mass and volume is Rhodium. It is followed by Caesium, Iridium and Palladium by mass and Iridium, Gold and Platinum by volume. Unlike more common metals, Caesium is use in niche applications, meaning even minor supply constraints can send prices skyrocketing.

Despite its premium valuation, the Caesium market is notoriously opaque, as there’s only several suppliers worldwide. China’s grip on Caesium mining means that Wester buyers usually pay huge premiums to secure limited quantities. And with increased demand from space agencies, defence contractors, and semiconductor manufacturers, prices are expected to climb even higher.

The issue with Caesium is that scaling up production is very difficult. Caesium is found in pollucite, a rare mineral that occurs in only a few known locations globally. Obviously new discoveries will shift the supply landscape, but until then, Caesium’s price tag will continue to reflect its importance.

Base Metals

Kazakhstan Secretly Ramps Up Caesium Mining

Kazakhstan became an unexpected player in the global Caesium market, Kazakhstan has historically kept a low profile in rare metal mining, but recent discoveries suggest it may hold some of the world’s last untapped Caesium reserves. With China already heavily invested in Kazakhstan’s mineral sector the West is growing increasingly concerned about their indirect control over these critical resources.

Kazatomprom, Kazakhstan’s state-run mining giant, has been continually scaling its Caesium extraction operations, though details remain unknown. Some analysts suspect that China’s growing reliance on Kazakh Caesium could create a strategic vulnerability for them, especially if Western powers attempt to disrupt the supply chain.

For now, Kazakhstan remains in China’s control. If it can increase production independently of China, it could offer a crucial alternative for the West, but given China’s significant influence and economic ties with Kazakhstan, this scenario seems quite unlikely.

Caesium’s Future

With Caesium’s role in atomic clocks, quantum technology, and national security, its now firmly on the radar of global policymakers. This creates an interesting situation with the U.S. and China where you could think of whether the U.S. can still establish an independent supply against China or if they have already lost. In my opinion, the U.S. probably will not be able to compete against China’s speed or funding in contract making and getting into operations but specifically as the U.S.’s bureaucracy gives them an instant headwind against China.

Power Metals Corp, Pioneer Resources, and U.S. defense contractors should all explore ways to bolster domestic Caesium production. But with China controlling most of the refining processing and refining infrastructure, securing a steady supply will likely remain a major challenge.

In the coming years, I would expect more geopolitical maneuvering, investment in new pollucite exploration projects and mining projects, and a push for stockpiling Caesium reserves. In this fight for technological supremacy, these next few years will involve Caesium being a strategic asset with global implications.

Thanks for reading The Mineral Strategist! This post is public so feel free to share it.